"The best time to plant a tree was 20 years ago. The second-best time is now." – Chinese proverb

Narratives drive markets and economies. At the height of the euro crisis in 2012, it was Mario Draghi’s (then President of the European Central Bank) short yet powerful phrase “whatever it takes” that ended a self-fulfilling run on weak European sovereigns and banks. In an eventful week with highly coordinated policy messaging and announcements, China is arguably at a similar turning point, and the market and economic narrative could well change.

However, scepticism about this potential inflection point is abundant. There have been a few false dawns in the past 18 months, so is this time different? We cannot help but remember Covid. The Chinese leadership stuck with its ‘zero-Covid’ policy for a year too long, in our view, then abruptly capitulated and reopened the economy within three days. Similarly, in its post-Covid fight against the deflationary doom loop, policymakers have been reactive and behind the curve for more than a year. In late September, we witnessed their capitulation on economic policy that we believe will likely change the market narrative for the better.

The four dimensions of China

At the risk of oversimplifying a complex issue, we view the current China story through four lenses:

- Geopolitical tension is here to stay. The strategic competition with the US is unlikely to change over the coming years, if not decades. This is volatility that investors must factor in.

- Structural economic challenges are not new and have no quick and easy solutions. Overreliance on investments to drive growth, worsening demographics and poor capital efficiency are daunting structural issues that will require a tremendous amount of determination, patience and finesse from the policymakers. Investors should not have high expectations of any near-term results.

- Negative wealth effects are hurting consumer confidence and cyclical growth, which can be tackled by policy stimulus. China has very high home ownership and 60% of household balance sheets is in property. Amid the longest and most severe housing downcycle, property prices are down anywhere between 20% and 40% across the country, which has significantly dampened the willingness of consumers to spend, despite record high savings.

- Business confidence is at record lows after almost five years of anti-business policies. The private sector needs an adrenaline shot and reassurance from the political elite to rekindle its animal spirits.

Unchangeable realities, game-changing focus

Out of these four, geopolitical tension is here to stay and structural economic challenges are unlikely to be resolved anytime soon. However, policy could have a huge impact on reversing the negative wealth effect and boosting business confidence. That is where policymakers have focused and why we can see a clear narrative shift.

The highly coordinated policy shift week began with a rare sight of the central bank head, financial institutions regulator and securities regulator sharing a stage to open the liquidity tap for the economy and financial markets. The underlying message was clear: the three most important policymaking technocrats on monetary policy were saying: “We want the stock market to go up”.

Two days later, the Politburo convened unexpectedly to discuss the economy. In itself, the off-cycle meeting sent a very strong signal, and the two core messages were: “We want property prices to stop going down” and “We will [finally] open the coffers for fiscal policy easing”. Central government has behaved like the dragon hoarding gold and treasure – now is the time to let it go.

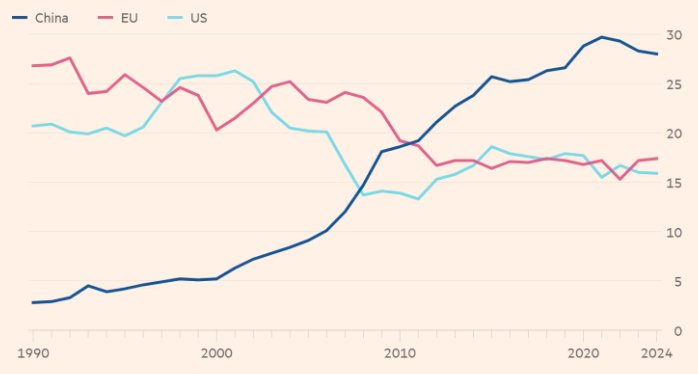

To break the doom loop of negative wealth effects, we need property prices to stop falling and other assets to go up. That is exactly the message we received. In this case, the other asset is the stock market. Unleashing the $20trn in Chinese household bank deposits on consumption and investment would significantly improve the economic outlook (see the graph below).

| Share of global savings (%) |

|

| Source: IMF, FT calculations 5 March 2024. |

Japanification risk and a fiscal bazooka

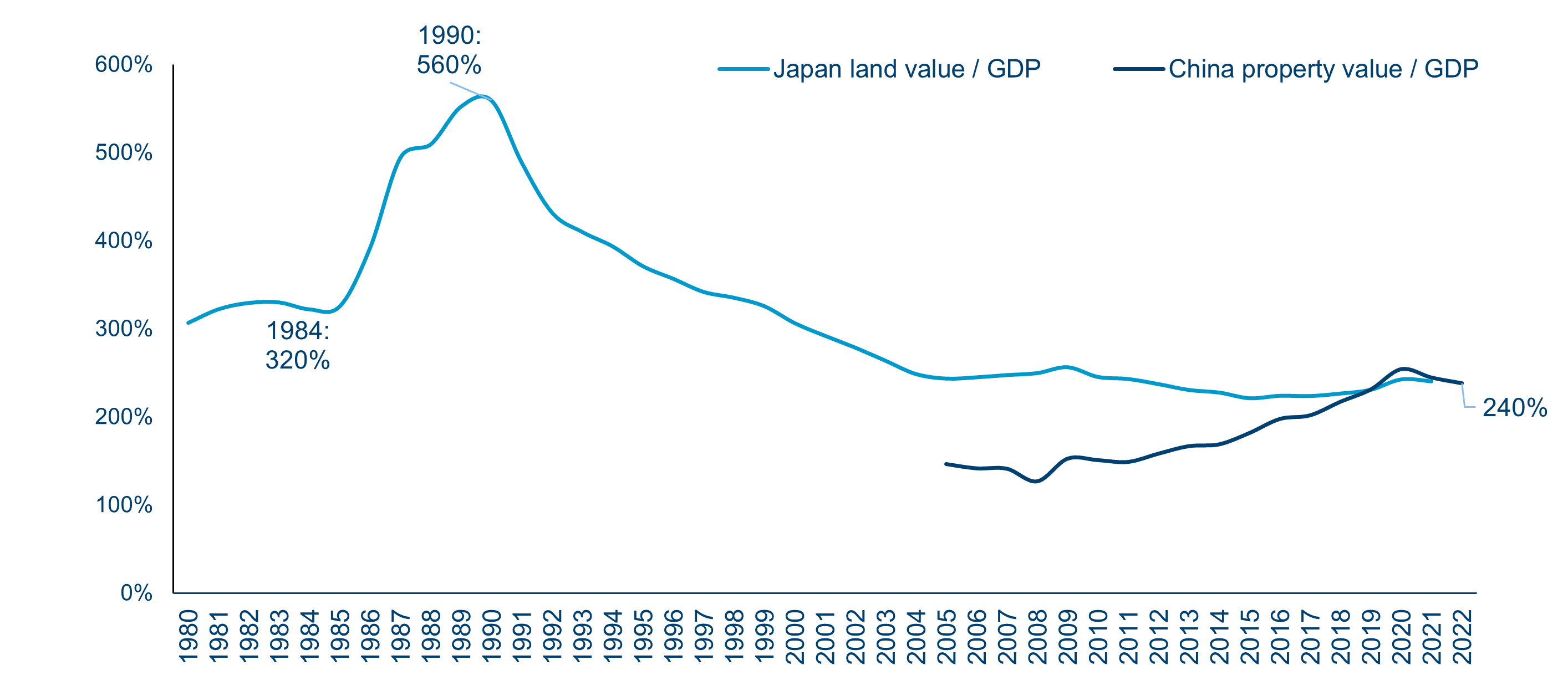

The parallel between Japan in the 1990s and China now is uncanny. Both are cases of asset deflation, however they differ in one important aspect as the challenge China is facing is of a significantly lower magnitude (see the graph below).

Asset price inflation was lower in China than Japan |

|

| Source: CEIC, Morgan Stanley. |

Nonetheless, the lessons from Japan are still critical for China if the authorities want to avoid a protracted and self-fulfilling downcycle. The policy response must be decisive, proactive and forceful. While monetary policy is important, to avoid the liquidity trap fiscal policy will be even more important. Unlike previous rounds of policy easing, which were mostly piecemeal and reactive, this weeks’ were proactive and decisive, and finally opened the door for fiscal action.

While the narrative and policy shifts are clear, decisive and encouraging, we need fiscal stimulus to come through on a huge scale to really make a difference to the economic fundamentals. The Politburo meeting was agenda-setting, so we should expect to see tangible fiscal stimulus in the coming weeks and months. We will be monitoring and assessing the various measures as they come out, so we will comment further in due course.

Portfolio implications

Chinese consumer assets are the clear winners. The crux of the policy shift is to boost consumer confidence and spending, and these assets are at historically low valuations with high operating leverage if topline growth accelerates. In the Polar Capital China Stars Strategy we have added to our high-quality portfolio of consumer spending-exposed holdings, making consumer discretionary the biggest overweight in our portfolio. In time, we believe higher consumer confidence and spending will boost business confidence, and translate into higher industrial and manufacturing capex. We have also selectively added companies in industrial automation and robotics to our portfolio.