Here are our reflections on markets in 2023 and our outlook for convertible bonds in 2024, outlining four key reasons why we believe the asset class remains a compelling investment proposition within investors’ portfolios.

Reflections on 2023

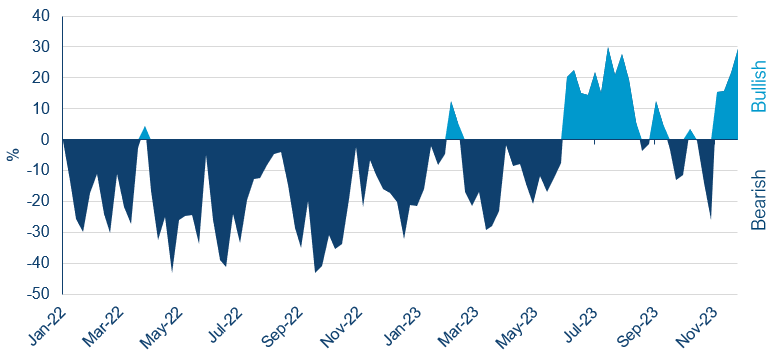

2023 was a year of large fluctuations. January began with consensus expectations for a slowing global economy, an ongoing western interest rate hiking cycle and, therefore, very low sponsorship of risk assets. Conversely, December saw the year ending with expectations of forthcoming rate cuts in Europe and the US, a likely soft or no landing in the US and investor sentiment at its highest levels in two years, as shown below. In between, markets experienced historically high interest rate volatility, historically low equity volatility, one of the narrowest equity markets in memory, one of the lowest equity risk premiums on record and interest rates that made a huge round trip to close the year largely unchanged. All of this leaves markets at a crossroads as we move into 2024.

Convertible bonds outlook

Despite this uncertainty, we are constructive on the outlook for convertible bonds as we head into 2024 for four key reasons. In particular, convertible valuations are cheap; equity volatility is at historic lows; the convertible investor base is broad; and convertible new issuance is expected to increase the opportunity set of the convertible investor.

Valuations

Convertibles are one of the only, if not the only, asset class that is objectively cheap. Even assuming the currently depressed levels of equity volatility persist, global convertibles are 1-1.5% below fair value which is among the cheapest they have been in many years.

In addition, the mixture of yields and conversion premia is similarly as attractive as it has been since at least 2016. This can be seen by looking at new issue pricing which is a good barometer of where convertible secondary markets are priced. According to Barclays, European and US convertible new issues in 2023 carried their highest coupons since at least 2015 in Europe and 2017 in the US. Similarly, the conversion premiums have been the lowest since at least 2017 in each geography.

This means that convertible investors are simultaneously receiving the highest income AND the greatest equity upside participation in many years. The obviously attractive economics this creates makes it unsurprising to see the evolution of the investor base that we note below.

Volatility

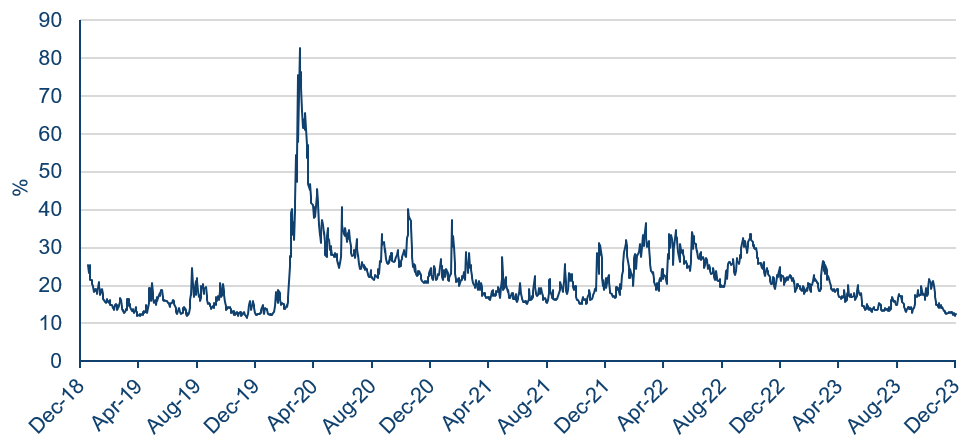

Convertible valuations are cheap on the assumption that volatility stays at current levels. Intriguingly, these levels of volatility are exceptionally low. As shown below, equity volatility has fallen back to multi year lows.

In our mind, there are many reasons to believe that volatility is likely to rise materially which, if it happens, would provide a direct tailwind for convertible values.

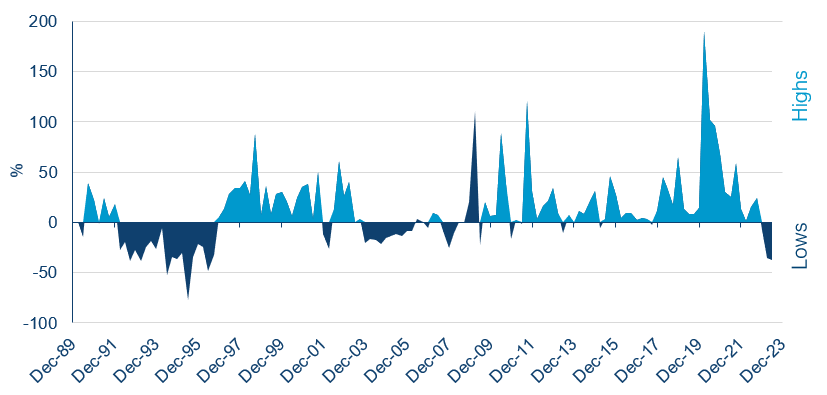

The most notable reason is the unprecedented gulf between equity volatility and fixed income volatility. As shown below, while equity volatility has fallen back to multi year lows, fixed income volatility has risen to multi year highs.

Indeed, the gulf between fixed income and equity volatility has risen to the second highest on record, behind only the 1994 bond market crisis.

The drivers of fixed income volatility are well known. Macroeconomic policy is at an inflection point, transitioning from a tightening phase to a loosening one, which increases interest rate uncertainty. Moreover, with over 50% of global GDP heading to the polls in 2024, it seems unlikely policy will become more certain in the year ahead. Against this backdrop, we believe fixed income volatility will likely remain elevated.

As fixed income and equity volatility have typically moved together, we believe it unlikely for equity volatility to stay at these depressed levels. As such, we anticipate rising equity volatility will be a boost to convertible returns in 2024.

Investor breadth

Convertible markets have a history of being dominated by a particular type of investor – hedge funds in the pre-GFC world and long-only investors until 2020. However, recent years have seen this broaden out substantially to become the most diverse investor base in recent memory.

This shift began in 2021 when the destabilisation caused by Covid caused multi-asset hedge funds to commit more capital to convertibles in search of both volatility and diversified sources of return. The subsequent decline in equity prices in 2022 reduced the price of many convertibles to below par. This encouraged a significant entrance of a new type of investor. As Jefferies notes, during 2022 and 2023, credit, distressed debt and high yield investors entered the market in such scale that they became a “significant player” in the asset class, taking their estimated share from under 1% to over 10%.

With each investor type having very distinct investment criteria and needs, this is a clear tailwind to liquidity and valuations, as well as to the overall stability of the asset class. It also implies that, should our projections for primary market issuance (below) prove correct, the convertible market is exceptionally well placed to digest this supply.

Primary market supply

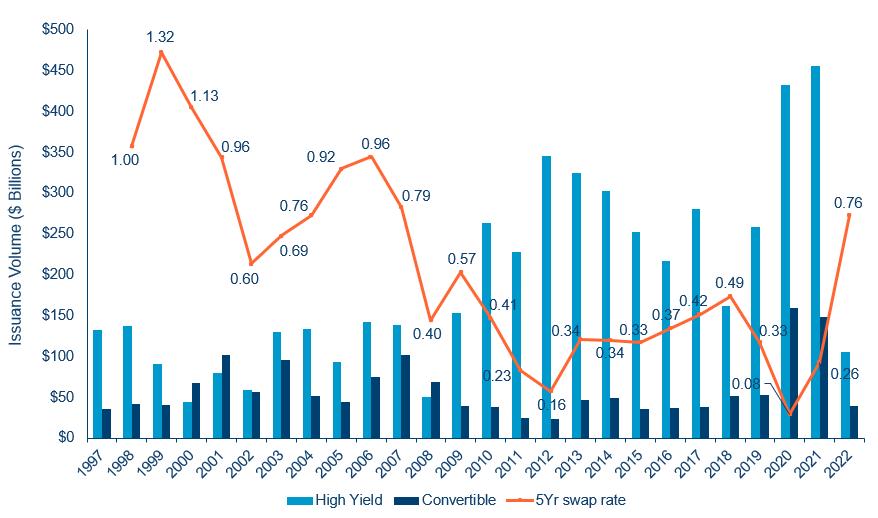

Many market participants, us included, expect 2024 to be a strong year for convertible issuance for two reasons. First, as interest rates rise, the coupon saving on a convertible bond compared to a straight bond becomes more meaningful for issuers. With interest rates near a multi-year peak in the US and Europe, Bank of America recently estimated companies in the US could save 500bp or more in coupon payments by issuing a convertible as opposed to straight debt – a significant amount.

Second, high yield issuance was especially strong in 2020 and 2021, as shown in the chart below. Much of this debt is coming due in 2025 and 2026. Indeed, According to Deutsche Bank, the refinancing ‘wall’ for both US and EU high yield bonds and loans begins to hit in January 2025. In the US, the amount of maturities increases from below $10bn per quarter to over $20bn in January 2025. From there, it rapidly increases to as much as $120bn by the first quarter of 2027. A similar dynamic exists in Europe where the increase is from under €5bn to over €10bn in early 2025 before rising to as much as €30bn by Q3 2026.

This is important because corporates typically look to refinance debt as soon as it becomes ‘current’ (i.e. has one year or less until maturity). This implies that refinancing should begin to increase materially in early 2024. Based on the relationship shown below, this implies that 2024 is likely to be the first of many years in which convertible issuance runs at above-average levels.

As we noted above, convertible issuance in 2023 has provided both the highest coupons and lowest conversion premiums in years, due both to the rise in interest rates as well as the more challenging capital-raising environment these hikes inevitably create. We believe this will continue.

Consequently, we believe we may be on the precipice of a Golden Age for convertible primary markets, one where there is a large volume of convertible bonds issued at attractive pricing. Primary issuance may therefore be a material and durable tailwind for convertible returns in 2024.

Summary

In summary, we believe there are four key tailwinds for convertible performance in 2024: (1) they are attractively priced; (2) the primary driver of their value (volatility) is likely to rise; (3) the investor base is in good health; and (4) there is likely to be a sustained level of attractive issuance.

These positives stand in contrast to equity and fixed income markets where the outlook is more uncertain. As such, we believe convertibles are likely to provide strong risk-adjusted performance in 2024 and would encourage investors to consider including convertibles in their portfolios in the year ahead.