The world has a weight problem. In the UK alone, obesity costs the NHS around £6.5bn each year, with 26% of English adults now living with the condition1. Treatment costs the US healthcare system $147bn annually2. A significant barrier to public health on its own, obesity also increases the risk of hypertension, high cholesterol, type two diabetes, heart disease, certain cancers and reduces life expectancy. Worryingly the situation is worsening, prompting the UK government to intervene with a £20m research boost to develop new medicines and digital tools designed to allow patients to reduce and prevent outsize weight gain3. The programme places obesity alongside three other headline public health issues (cancer, mental health and addiction) in tackling what is projected to amount to £10bn in NHS spending by 2050. Part of this is education and public awareness, as in the recent addition of calorie counts to restaurant menus. However, the greatest potential for sustained weight loss is likely to come from the pharmaceutical sector, with major breakthroughs capturing the market’s attention over the summer.

Early in August, Danish pharmaceutical company Novo Nordisk published positive clinical trial results for its weight-loss drug Wegovy. The study showed the drug reduces the risk of major adverse cardiovascular events by 20% in adults with obesity and established cardiovascular disease. A positive surprise, the results proved to be a significant catalyst not just for Novo Nordisk but for other companies with similar assets in late-stage development for obesity, notably Eli Lilly.

Investors were quick to deem companies with existing products, or those with related advancing obesity pipelines, as prime beneficiaries of this development. Conversely, markets applied discounts to companies providing products that currently help treat obesity, such as obesity-related technology and equipment used in bariatric surgery and sleep apnoea.

The thinking here suggests a new wave of weight-loss drugs will make existing treatments relating to obesity and connected health issues redundant. While we welcome the additional therapeutic tool for the treatment of diabetes and obesity, we feel it is too early to agree with the extent of the market mark-downs. The opportunity set for these weight-loss drugs and the companies providing them should not be underestimated, however the long-term picture will likely be less binary than the market’s initial assessment.

The opportunity for GLP-1s

Originally approved in 2005 as medicines to treat type two diabetes, glucagon-like peptide-1 receptor agonists (GLP-1s) were also found to suppress appetite by tricking the body into feeling full and reducing the rate of digestion. However, it took a subsequent approval in 2021, this time specifically for GLP-1s to be prescribed for weight loss, as well as a study revealing cardiovascular risk improvement, before this year’s market excitement began.

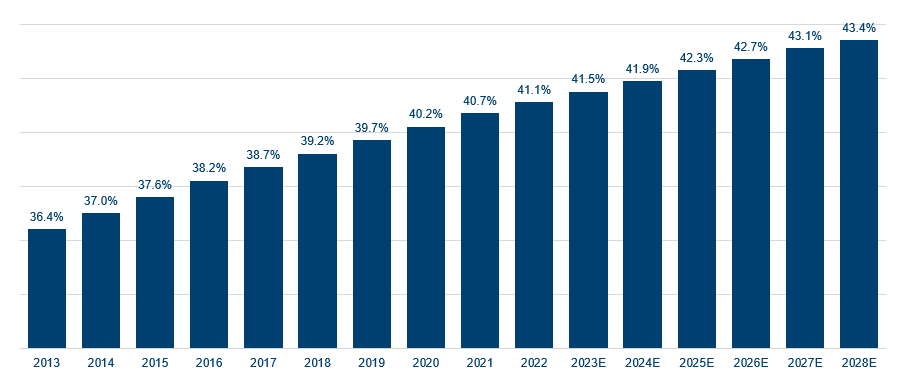

With the worldwide prevalence of obesity nearly tripling between 1975 and 2016, according to the World Health Organisation (WHO)4, and over one billion adults set to be obese by 2030, up from 770 million in 20205, it is perhaps no wonder the market sought to price in the opportunity. The World Obesity Federation predicts the global economic impact of issues relating to being overweight or obese will reach $4.3trn annually by 2035 if prevention and treatment measures do not improve. This would amount to almost 3% of global GDP, on a par with the impact of Covid-19 in 20206.

Share of worldwide population considered overweight

Source: WHO, Jefferies, October 2023. Forecasts are based upon subjective estimates and assumptions about circumstances and events that may not yet have taken place and may never do so. Forecasts contained herein are for illustrative purposes only and does not constitute advice or a recommendation.

Given the severity of the projections and the early success of GLP-1 breakthroughs, Morgan Stanley now believes the global obesity treatment market could hit $77bn by 2030 compared to earlier estimates of $54bn and recorded spending of $2.4bn in 20227. Jefferies forecasts the market for GLP-1 drugs could exceed $100bn in sales8. The stage, therefore, is set for corporate efforts to calm this trajectory and take part in the economics of addressing a clear public health problem.

Markets race to back GLP-1 beneficiaries

In a bid to identify the beneficiaries of the theme, the market has homed in on the headline GLP-1 drug developers. Novo Nordisk, whose Wegovy injection treatment is joined by stablemate Ozempic, sits alongside Eli Lilly, maker of competitor Mounjaro, at the top of the pile so far.

In August, both firms announced huge upticks in GLP-1 consumption, with Novo Nordisk reporting a 344% uplift in Wegovy’s US sales to almost $1.7bn, while Eli Lilly’s Mounjaro generated $915.7m in US quarterly sales, up from $16m a year ago, albeit having only launched in June 20229. The biggest barrier to sales here seems to be fulfilling orders, as supply cannot keep up with ‘significant’ demand. Encouragingly, while Mounjaro currently only has Food and Drug Administration (FDA) approval to treat diabetes, Eli Lilly has applied for permission to specifically treat obesity, expecting approval in late 2023 or early 2024. Both stocks have seen strong performance as investors react to the inherent growth opportunity.

The market has been quick to identify GLP-1 casualties

In contrast, device makers exposed to areas such as bariatric surgery and diabetes have come under pressure. Medical device companies Inspire Medical Systems and DexCom have had a challenging time, with the key driver being concerns the weight-loss drugs will permanently impair the companies’ addressable markets, namely sleep apnoea devices and continuous glucose monitoring. However, while the short-term market judgement has been swift and binary, as nuance starts to replace initial excitement it is likely this chasm will give way to a more measured assessment of the role of both drug producer and incumbent. We believe the noise thus far has arguably already become excessive, with speculation around changing consumption habits hitting restaurant and hospitality stocks, as well as those in alcohol, smoking and even gambling.

Both Novo Nordisk and Eli Lilly have seen uneven share-price movements since the summer and have seen bouts of profit-taking, putting further weight behind avoiding a superficial reading of the winners and losers, driven by exuberance rather than judgement.

Investing in the stewards of capital, not the drugs

While both have performed strongly in 2023 more broadly, our Strategy's preferred exposure is to Eli Lilly. Not only do we believe Eli Lilly is a more diversified business, with established franchises in oncology and immunology, we believe it has a potentially superior obesity franchise driven by what appears to be greater levels of weight loss. Further, Eli Lilly might also have an opportunity to move into Alzheimer’s disease with a drug called Donanemab.

Considerations beyond the initial drama

While the data is genuinely exciting, it is our view that we need to see more real-world evidence of the drugs’ long-term benefits before materially reducing the addressable markets for the aforementioned medical device companies. It is very difficult to quantify today the broader impact tomorrow on the medical devices sector and indeed on the long-term health implications of patients that take weight-loss drugs over a sustained period. There are also further considerations that need to be explored and clarified, beyond scaling the weight-loss revenue opportunity set.

First, current treatments are delivered by injection. Pill versions would likely see much greater public adoption and, with oral weight-loss drugs currently being tested by Novo Nordisk, Eli Lilly, Pfizer, Amgen and now AstraZeneca, the beneficiary picture could still change.

Second, there is still uneven insurance coverage for the drugs across the US. Where they are covered, it is often solely for type-two diabetes treatment, not weight loss, or only through select insurers. While this might change in light of recently discovered cardiovascular benefits, it is another hurdle to a clear view of consumption.

Third, if GLP-1 efficacy accelerates weight loss for patients who only become eligible for other procedures once they reach a healthy weight, pipeline volumes for medical devices, artificial joints and aftercare such as wearable health trackers could increase.

Ultimately, while the short-term market reaction may seem straightforward, the full extent of the narrative is yet to be fully understood both in terms of beneficiaries, casualties and further opportunities evolving on the back of current developments. In our experience, this is often where mispricing occurs, as firms are dismissed too quickly or heralded as leaders too early, and there will likely be a wide range of interesting investment opportunities driven by the recent dislocation once the market has all the relevant clinical data and the euphoria dies down.

2. Making Healthy Living Easier (cdc.gov)

3. New obesity treatments and technology to save the NHS billions - GOV.UK (www.gov.uk)

4. Obesity and overweight (who.int)

5. Prevalence of Obesity | World Obesity Federation

6. Economic impact of overweight and obesity to surpass $4 trillion by 2035 | World Obesity Federation

7. Weight Loss Drugs Boost Obesity Market Value | Morgan Stanley